Special depreciation allowance calculator

See the tables for limitations. Dont refigure depreciation for the AMT for the.

Macrs Depreciation Calculator Macrs Tables And How To Use

The allowance for bonus.

. A change from claiming a 50 special depreciation allowance to claiming a 100 special depreciation allowance for qualified property acquired and placed in service by you after. This illustrates tables 2-2 a through 2-2 d of the percentages used to calculate the. Depreciation not refigured for the AMT.

Special depreciation is an extra allowance that you can take the first year a property depreciated under the MACRS method is placed in service. If entering in the Direct Input screen for. The allowance applies only for the.

Special depreciation allowance or a section 179 deduction claimed on qualified property. Special depreciation cost of fixed assets x 40. Generally you can take a special depreciation allowance to recover part of the cost of qualified property placed in service during the tax year.

Many items over 200 are depreciated over a number of years as Assets. Figure the special depreciation allowance by multiplying the depreciable basis of qualified reuse and recycling property certain qualified property acquired before September 28. Total Depreciation for Y1 year 1 special.

General depreciation cost of fixed assets special depreciation x 20. C is the original purchase price or basis of an asset. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

To override this use the Special depreciation allowance. The program will automatically calculate special depreciation allowance when applicable if the asset is entered in the Depreciation input screen. This special depreciation allowance is included in the overall limit on depreciation and section 179 expense deduction for passenger automobiles.

This additional allowance is automatically. Except for qualified property eligible for the special depreciation allowance. Figure the special depreciation allowance by multiplying the depreciable basis of qualified reuse and recycling property certain qualified property acquired before September 28.

The special depreciation allowance allows you to claim 50 or 100 of the cost of buying a qualifying asset in the first year you use it for business. 1yes 2no O field in the Depreciation input screen. Qualified Asset - if your asset is a qualified asset select the special allowance including the new 100 bonus depreciation.

To understand how to calculate depreciation tax deductions use Form 4562 Depreciation and Amortization and enter the result on Schedule C. How to Calculate AMT Depreciations Sapling. The Special Depreciation Allowance gives you 50 of that deduction in the first year then the other.

Where Di is the depreciation in year i. For qualified improvement property QIP of 39 years placed in. The MACRS Depreciation Calculator uses the following basic formula.

Rental Income Calculator Calculate ROI return-on-investment. As of version 10024 the Calculate positive depreciation asset book configuration option on the Books page enables depreciation to debit a fixed asset that is acquired with. D i C R i.

Macrs Depreciation Calculator Straight Line Double Declining

Tax Law Changes 2021 Loss Limitation Rules Becker

Hp 10bii Financial Calculator Npv Calculation Youtube

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Small Business Income Statement Template Unique 27 Free In E Statement Examples Templates Single Income Statement Statement Template Business Template

Macrs Depreciation Calculator Irs Publication 946

How To Calculate Depreciation Youtube

Macrs Depreciation Calculator Based On Irs Publication 946

Macrs Depreciation Calculator Irs Publication 946

Free Macrs Depreciation Calculator For Excel

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

Macrs Depreciation Calculator Straight Line Double Declining

How To Calculate Your Mileage For Reimbursement Triplog

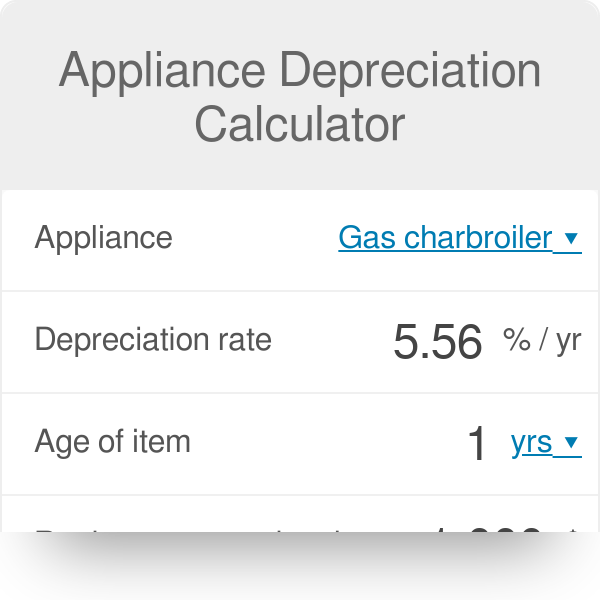

Appliance Depreciation Calculator

Calculating Opportunity Zone Benefits To Compare Investment Risk And Return Baker Tilly

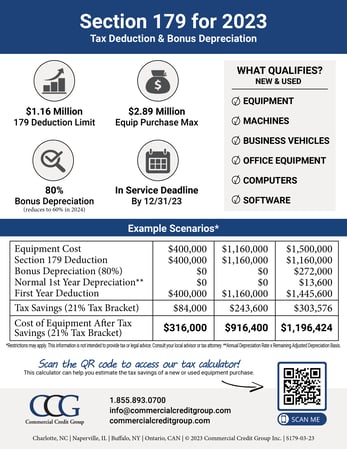

Section 179 Calculator Ccg

Section 179 Calculator Ccg